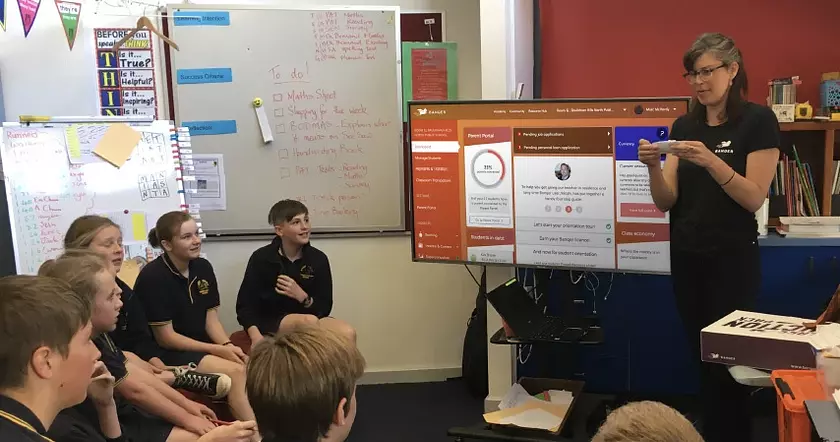

Bob Beekhof was immediately struck by the numerous applications of Banqer in the classroom. As he navigated the platform, he discovered opportunities to extend beyond immediate curriculum ties and delve into broader financial and life lessons.

Discovering the Potential of Banqer

Bob found the setup process straightforward and could effortlessly start simulating authentic experiences for his students. He did this by enabling various modules and introducing novel financial concepts to the class. His students found this real-world system simulation thrilling, serving both as a motivational and learning tool.

Employment and financial responsibilities

In terms of financial education, Bob's students had to earn their income through employment in classroom jobs. They relished creating resumes and applying for jobs on the market. The responsibilities that came with having a job were discussed and reinforced with financial consequences when tasks were not completed as per the agreed terms.

Saving, spending and discussions about money

Most students enjoyed the aspect of spending money, but they also loved to save! They were highly engaged and often discussed the financial decisions they were making. Top savers and those with high net wealth were frequently asked to explain their money-raising strategies. The activation of the interest module led to extensive conversations about the positive and negative effects of interest.

Learning from mistakes in a safe environment

Students also enjoyed purchasing properties as they learnt the intricacies of property acquisition. Those who didn't insure the properties they bought learnt the hard way when Bob triggered a natural disaster! This served as a practical lesson on the advantages and disadvantages of home ownership.

Additionally, the concept of financial consequences for inappropriate behaviour or errors in online transactions was a valuable learning experience. These instances were often used as discussion points for further deliberation.

Bob's experience with Banqer in the classroom highlights the platform's potential as an engaging and effective tool for imparting financial literacy and broader life skills to students.

Banqer Primary is available to primary schools throughout Australia at no cost, thanks to our Champion Partner Netwealth. Teachers can sign up via our site or book an online demo to help them get started and set up.